how are property taxes calculated in lee county florida

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A The median property tax on a 35740000 house is 239458 in Collier County.

Florida Property Tax H R Block

Beginning with the first year after you receive a homestead exemption when you purchase property in Florida an appraiser determines the propertys just value.

. Assessed Value of Home. In Harris County where Houston is located the average effective property tax rate is 203. If the taxes remain unpaid the delinquent property will be advertised once a week for 3 consecutive weeks prior to.

They are levied annually. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. Taxes must be paid in full and at one time unless the property owner has filed for the installment program or partial payment plan.

Substantial discounts are extended for early payment. How are property taxes calculated in Lee County Florida. The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

In Jackson County Missouri residents pay an average effective property tax rate of 135. Within those limits the. Taxation of real property must.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. As an example if the county had your home assessed at 200000 you would pay property taxes based on a 150000 taxable value if you used the property as your primary residence aka homestead. It has an effective property tax rate of 095.

Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value. 1000001000 X 48325 48325. The median property tax on a 21060000 house is 204282 in florida.

Florida property taxes are relatively unique because. Using this feature you can determine the cost for Deeds Mortgages and other standard documents that we accept. How are property taxes calculated in Lee County FL.

The median property tax on a 35740000 house is 375270 in the United States. 1 be equal and uniform 2 be based on present market value 3 have a single estimated value and 4 be held taxable unless specially exempted. 100000 this is the available portability amount Percentage.

The rates are expressed as millages ie the actual rates multiplied by 1000. The Lee County Sales Tax is collected by the merchant on all qualifying sales made within Lee County. For the purposes of this Estimator we use the tax rate from the immediately previous tax year.

Lee County is in Southwest Florida along the Gulf Coast. Available portability-80000 40 of 200000 New Property Assessed Value. Lee County calculates the property tax due based on the fair market value of the home or property in question as determined by the Lee County Property Tax Assessor.

How are property taxes calculated in Lee County FL. The median property tax on a 35740000 house is 239458 in Collier County. What is the penalty for delinquent real estate property taxes in lee county florida.

The Clerks office is responsible for determining who may be entitled to surplus money left over from a sale pursuant to Florida Statute. To inquire about tax deed surpluses please contact The Law Offices of Travis R. Historically tax rates have fluctuated within a fairly narrow range.

Shown below we have provided the ability online to calculate the fees to record documents into the Official Record of Florida counties. The actual tax rate may differ based on the decisions made by those taxing. The actual tax rate used to calculate property taxes is set every year by the various taxing authorities in Lee County.

Total Price100 x 70 Doc Stamps Cost. Five months elapse before real property owners can be penalized for non-payment of taxes. Ad Search for Property Tax Records from the Comfort of Your Own Home.

Divide the taxable value by 1000 and multiply by the millage rate. This service is provided by a private attorney. The total amount of exemption.

Your homes just value is usually assessed at 85-95 of the total. The rates are expressed as millages ie the actual rates multiplied by 1000. Ad valorem taxes are based on the value of property.

How do I calculate my property tax. Non-ad valorem assessments are fees for specific services such as solid waste disposal water management sewer storm water and special improvements. Each property is individually t each year and any improvements or additions made to your property may increase its appraised value.

Property tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. How are property taxes calculated in lee county florida. Our Lee County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States.

So for example if your home has a market value of 150000 close to the countys median value you may be paying about 1410 annually in real estate taxes. Owners rights to reasonable notification of rate hikes are also mandated. Tax notices are mailed on or.

With each subsequent annual assessment your. The median annual real estate tax payment in Lee County is 1967. The median property tax on a 35740000 house is 346678 in Florida.

Next it allowed for Florida Homesteaded property owners to transfer or port their Save-Our-Homes benefits to a new property. While many other states allow counties and other localities to collect a local option sales tax Florida does not permit local sales taxes to be collected. The Lee County Florida sales tax is 600 the same as the Florida state sales tax.

The rates are expressed as millages ie the actual rates multiplied by 1000. Determine the taxable value of the property. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on.

¹ If you need to determine the fees for a document that does not require the collection of Documentary Stamp Taxes leave the field. Property tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. 40 the value difference is 40 of the Market Value New Homestead Property.

The taxes due on a property are calculated by multiplying the taxable value of the property by the. Property tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Scan Millions of Lee County Assessor Records Including Property Tax Reports.

Overview of Jackson County MO Taxes.

How To File For Florida Homestead Exemption Tampa Bay Title

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Cape Coral Florida Condos For Sale Cape Coral

Florida Property Taxes Explained

Florida Restaurant Lodging Association Frla

Lee County Fl Property Tax Search And Records Propertyshark

Florida Real Estate Taxes What You Need To Know

Investing In Florida Tax Liens Deeds Walkthrough Tltv Ep 10 Youtube

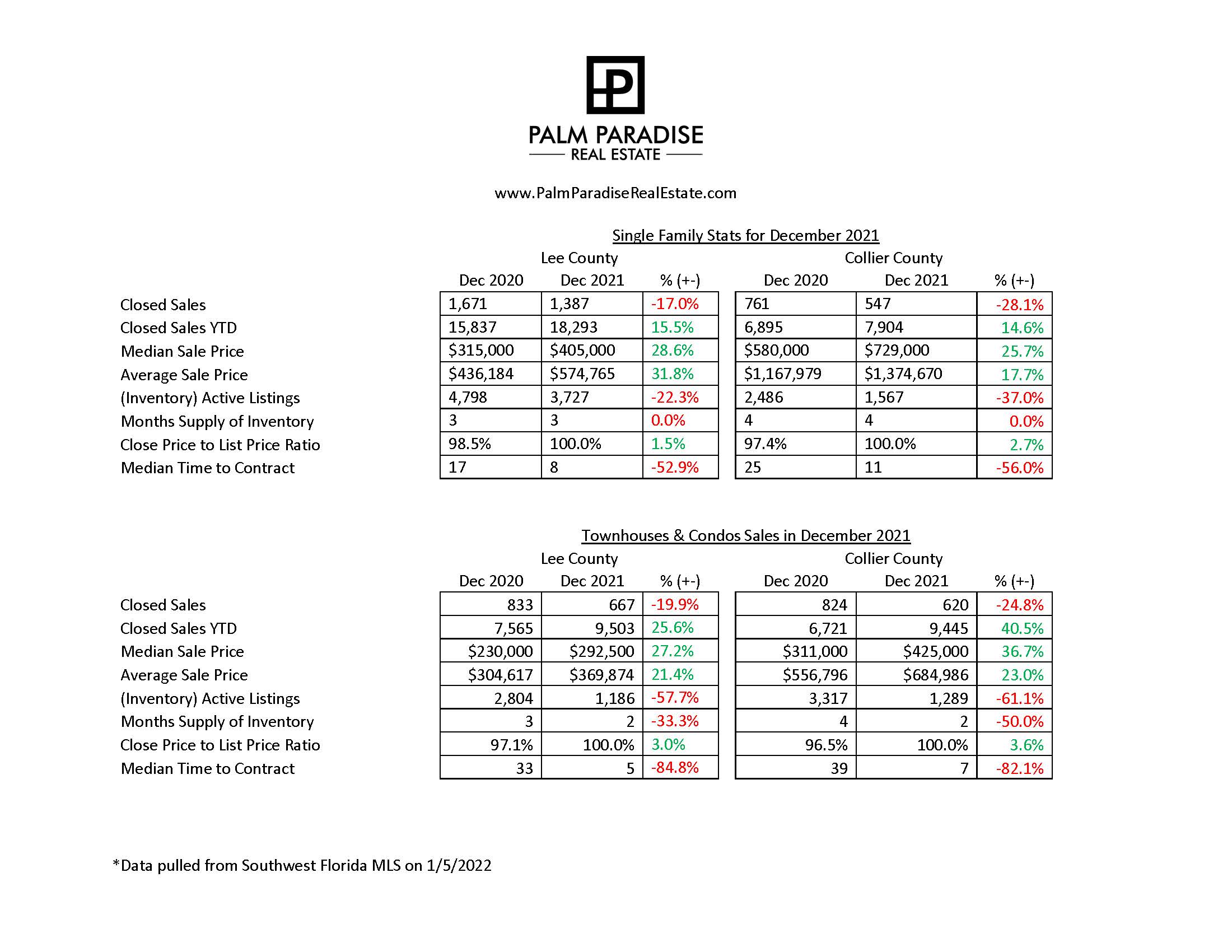

January 2022 Real Estate Market Update

Florida Sales Tax Guide And Calculator 2022 Taxjar

Palm Beach County Fl Property Tax Search And Records Propertyshark

What Is Florida County Tangible Personal Property Tax

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Lee County Fl Property Tax Search And Records Propertyshark

Is Shipping In Florida Taxable Taxjar

Florida Dept Of Revenue Property Tax Data Portal